2025

Year in Review

Read about the progress we’ve made this year to help make ICBC better.

Making affordability a priority

Improving the services you need

Safer roads for everyone

Showing up in our communities

We’re making progress on our Reconciliation commitments

A snapshot of ICBC’s 2024/25 financial status

Making affordability a priority

We're committed to delivering affordable products and services.

Basic insurances rates remained stable for the seventh year in a row, and we're keeping them stable until Spring 2027.

Customers with eligible insurance policies received a $110 rebate, thanks to prudent fiscal management and our strong financial position.

Enhanced Care benefits were expanded to include counselling for family members of loved ones who’ve been severely injured in a crash. We also increased the mileage reimbursement rate for customers needing to travel for treatments.

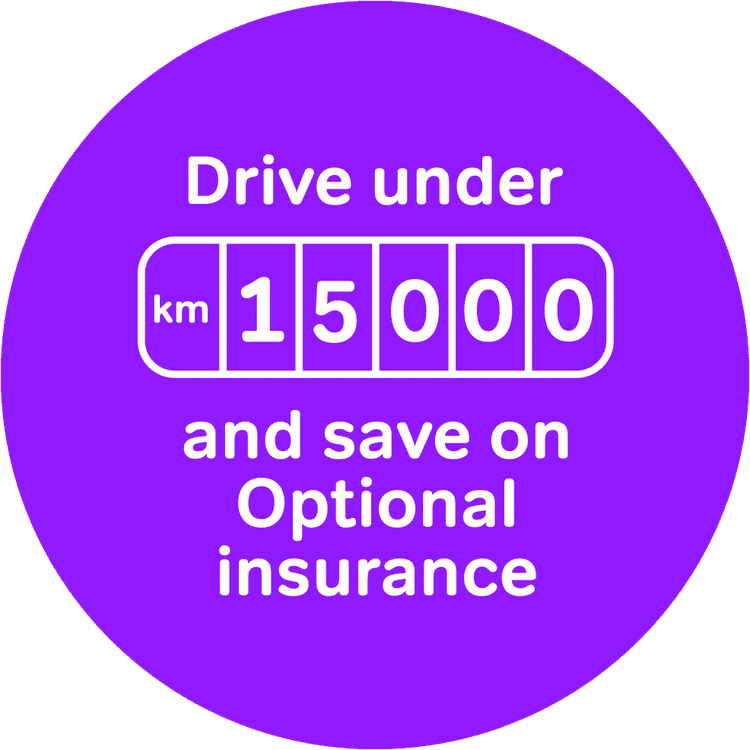

More customers are seeing increased savings on some Optional coverages, thanks to a greater distance threshold of 15,000 kilometres per year for our distance-based discount.

We're committed to delivering affordable products and services.

Basic insurances rates remained stable for the seventh year in a row, and we're keeping them stable until Spring 2027.

Customers with eligible insurance policies received a $110 rebate, thanks to prudent fiscal management and our strong financial position.

Enhanced Care benefits were expanded to include counselling for family members of loved ones who’ve been severely injured in a crash. We also increased the mileage reimbursement rate for customers needing to travel for treatments.

More customers are seeing increased savings on some Optional coverages, thanks to a greater distance threshold of 15,000 kilometres per year for our distance-based discount.

Improving the services you need

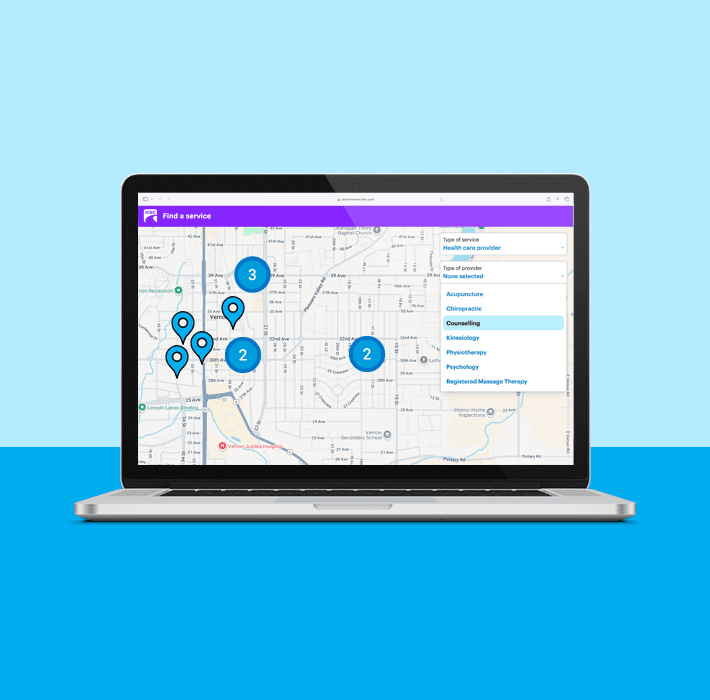

Customers recovering from a crash can find local health care providers in their communities using our new health care provider locator tool.

Lease your vehicle? You can now renew your policy online, receive rebates directly and update your coverages without lessor approval.

To help us manage growing demand for driver testing, we opened a centralized commercial road test facility in Coquitlam and expanded our commercial road testing in Chilliwack.

Safer roads for everyone

Each year, ICBC helps share the cost of road improvement projects across B.C. One of these projects, along Guildford Way in Coquitlam, was completed in Spring 2025.

Showing up in our communities

We’re committed to making a positive impact in the communities where we live and work.

ICBC employees were proud to walk in this year’s Pride parades in Kelowna, Victoria and Vancouver.

$1,000

raised for BC Children’s Hospital

$1,000

raised for United Way British Columbia.

ICBC’s partnerships with organizations like the BC Lions and BC Hockey League give us a chance to meet customers where they’re at — like their favourite cultural or sporting events.

These partnerships provide a fun and engaging way to remind people about the importance of safe driving. We hope to see you at an event soon!

We’re committed to making a positive impact in the communities where we live and work.

ICBC employees were proud to walk in this year’s Pride parades in Kelowna, Victoria and Vancouver.

$1,000

raised for BC Children’s Hospital

$1,000

raised for United Way British Columbia.

ICBC’s partnerships with organizations like the BC Lions and BC Hockey League give us a chance to meet customers where they’re at — like their favourite cultural or sporting events.

These partnerships provide a fun and engaging way to remind people about the importance of safe driving. We hope to see you at an event soon!

We’re making progress on our Reconciliation commitments

We're committed to meaningful Reconciliation with Indigenous Peoples and have made it a part of our corporate strategy. We know that our Reconciliation journey is an ongoing process of listening, learning and unlearning.

A snapshot of ICBC’s 2024/25 financial status

ICBC’s net income for the 2024/25 fiscal year was $1.651 billion, which was higher than forecast, mainly due to investment income and lower claims costs than expected.

Like the previous year, global financial markets performed better than predicted. This had a positive impact on ICBC’s investments, which resulted in an investment income of $1.411 billion.

This year, ICBC returned more than 95 per cent of claims costs, in the form of benefits, directly to customers.

For a more in-depth look at ICBC’s financials, you can read our Annual Report.